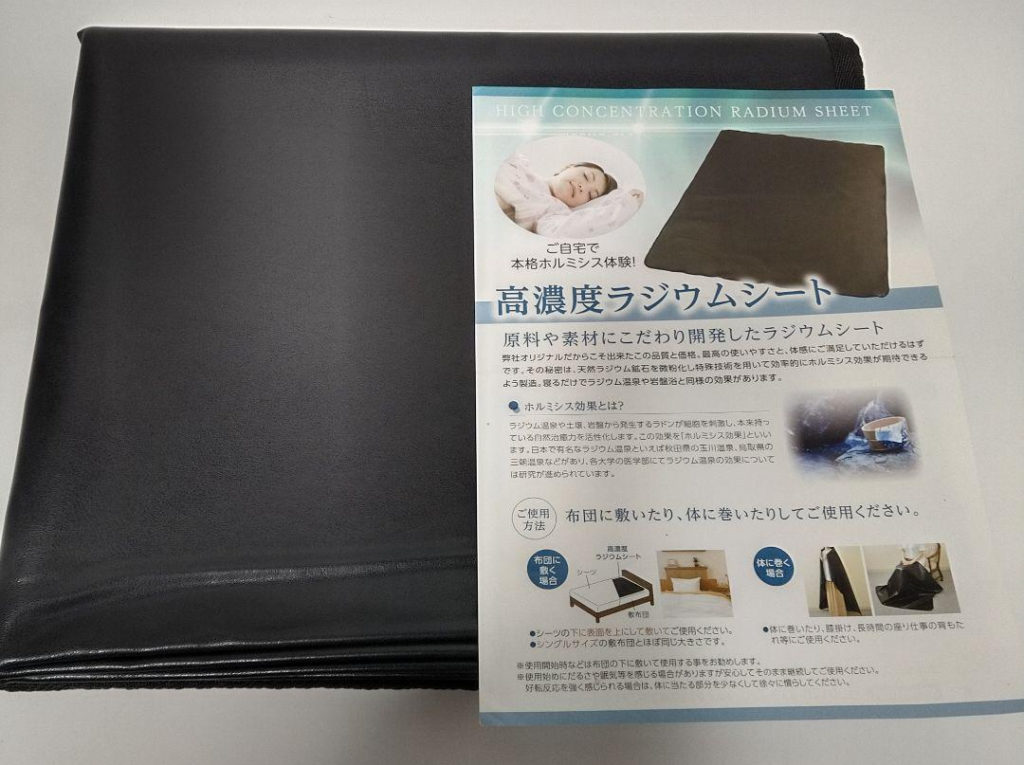

【最終お値下げ】ワールドレップサービス*ホルミシス高濃度ラジウムシート

(税込) 送料込み

商品の説明

ワールドレップサービスのホルミシス高濃度ラジウムシートです。

20万ほどで購入しました。他にも持っていてこちらを使っていないので出品致します(* > _ > *)

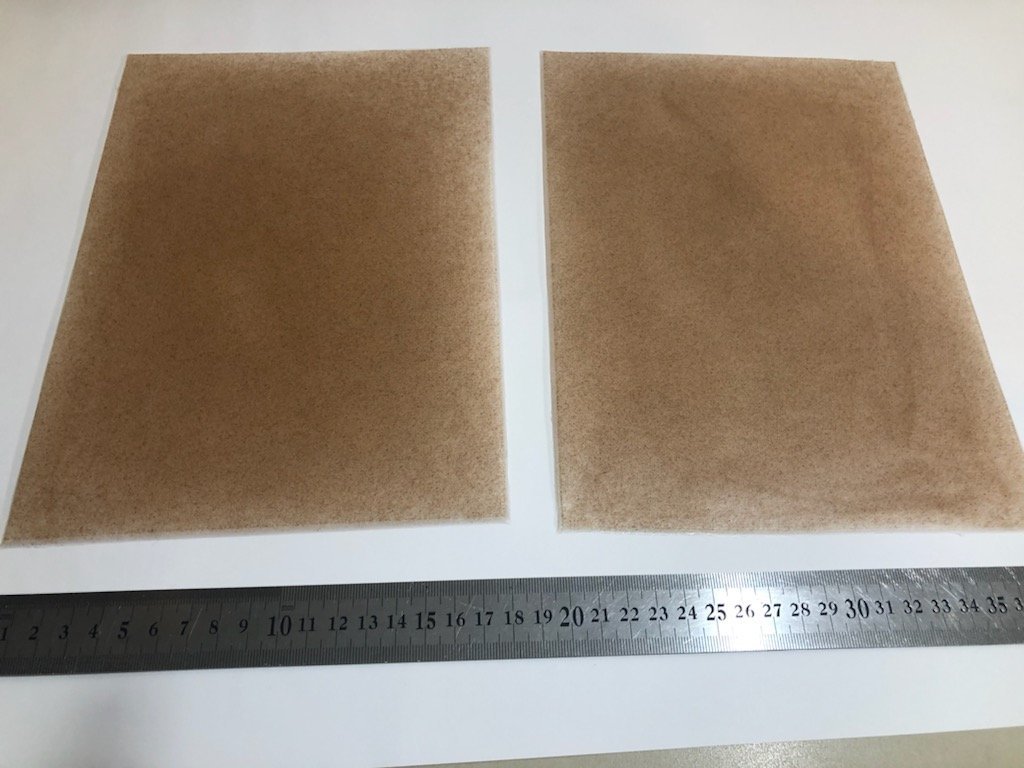

ほとんど新品未使用ですが、保管による折りジワがあります。説明書はありません。ご理解の上ご購入よろしくお願い致しますm(__)m

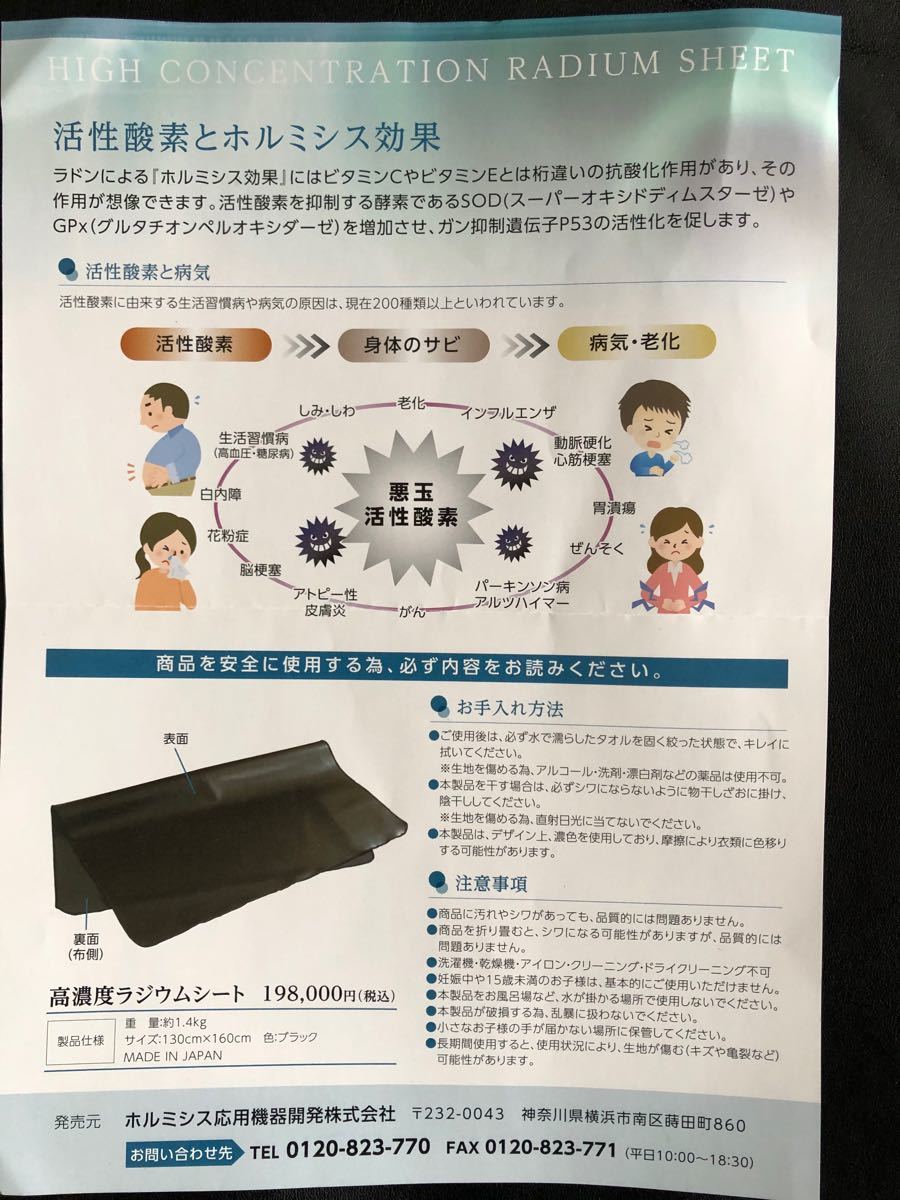

【商品説明】活性酵素とホルミシス効果 ラドンによるホルミシス効果にはビタミンCやビタミンEとは、桁違いの抗酸化作用があり、効果が想像できます。

活性酵素を抑制する酵素であるSOD(スーパーオキシドディムスターゼ)やGPx(グルタチオンペルオキシダーゼ)を増加させガン抑制遺伝子P53の活性化を促します。

ワールドレップサービスのサロンでも使用されています。

【使用方法】本製品は、布団に敷いたり、体に巻いたりしてご使用ください。

使用開始時などは布団の下に敷いて使用することをおすすめ致します。

使用初めにだるさや眠気等を感じる場合がありますが安心してそのまま継続して ご使用下さい。

好転反応を強く感じられる場合は、体に当たる部分を少なくして徐々に慣らしてください。

【お手入れ方法】ご使用後は必ず水で濡らしたタオルを固く絞った状態で拭いてください。

※生地を痛めるためアルコール、洗剤、漂白剤などは使用不可。

本品を干す場合はシワにならないように物干し竿にかけ、陰干ししてください。

本品はデザイン上、濃色を使用しており、摩擦などで洋服に色移りする可能性があります。

【注意事項】本品を折り畳むとシワができますが、品質的には問題はありません。

カラー···ブラック商品の情報

| カテゴリー | 家具・インテリア > 寝具 > シーツ・カバー |

|---|---|

| 商品の状態 | やや傷や汚れあり |

最新入荷 高濃度ラジウムシート ワールドレップサービス ホルミシス高

ラジウム 高濃度 ラジウムシート ラジウムマット ワールドレップ

ラジウム 高濃度 ラジウムシート ラジウムマット ワールドレップサービス-

正規版 高濃度ラジウムシート ワールドレップサービス | www.barkat.tv

ショッピング大特価 ワールドレップサービス高濃度ラジウムシート

ワールドレップサービス*高濃度ラジウムシート 公式通販店 インテリア

ホルミシス高濃度ラジウムシート ワールドレップサービス - 素材/材料

高濃度 ラジウムシート ワールドレップサービス abitur.gnesin-academy.ru

高濃度ラジウムシート ワールドレップサービス - シーツ

ラジウム 高濃度ラジウムマット ワールドレップサービス

ホルミシス高濃度ラジウムシート ワールドレップサービス - comicom.ma

ラジウム 高濃度 ラジウムシート ラジウムマット ワールドレップサービス-

ワールドレップサービス 高濃度ラジウムシート その他 パリ で 買う

高濃度ラジウムシート bibliotecagyscr.org

ホルミシス応用機器高濃度 ラジウムシート ワールドレップ - その他

ショッピング大特価 ワールドレップサービス高濃度ラジウムシート

高濃度ラジウムシート ワールドレップサービス - シーツ/カバー

高濃度ラジウムシート ワールドレップサービス - シーツ

ショッピング大特価 ワールドレップサービス高濃度ラジウムシート

高濃度 ラジウムシート ワールドレップサービス abitur.gnesin-academy.ru

ワールドレップサービス ラジウムシート ボディケア ショッピング販売

高濃度ラジウムシート-

ラジウムシート-

高濃度 ラジウムシート ワールドレップサービス abitur.gnesin-academy.ru

高濃度ラジウムシート ワールドレップサービス - シーツ

非課税 ワールドレップサービス ラジウムシート - その他

ショッピング大特価 ワールドレップサービス高濃度ラジウムシート

高濃度ラジウムシート 新品-

ワールドレップサービス*高濃度ラジウムシート 公式通販店 インテリア

ショッピング大特価 ワールドレップサービス高濃度ラジウムシート

海外限定 高濃度ラジウムシート ワールドレップサービス 高濃度

高濃度 ラジウムシート ワールドレップサービス abitur.gnesin-academy.ru

ワールドレップサービス 高濃度 ラジウムシートの通販 by ❤︎petit

高濃度 ラジウムシート ワールドレップサービス abitur.gnesin-academy.ru

2024年最新】ラジウムシートの人気アイテム - メルカリ

ラジウムシート-

ホルミシス応用機器高濃度 ラジウムシート ワールドレップ - その他

ワールドレップサービス 高濃度 ラジウムシートの通販 by ❤︎petit

ワールドレップサービス 高濃度ラジウムシート お買得 値下げしました

高濃度 ラジウムシート ワールドレップサービス abitur.gnesin-academy.ru

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています