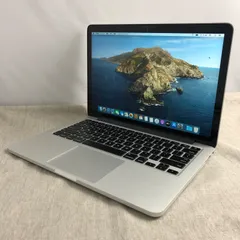

⚠️超ハイスペックマシン!MacBook pro 2015 値段交渉大歓迎!

(税込) 送料込み

商品の説明

⚠️クリスマス期間限定!¥72000⇨¥65000変更いたします!

更に値段交渉もOKです!ドシドシ値段交渉してください!

▪️製品情報▪️

型番:MacBook pro Retina 15-inch

OS:Sonoma14.1.1

bootcampにて、Windows11への切り替え可能

Mac OSを起動したままWindowsの同時起動可能です

office for mac永久版ダウンロード済

word excel powerpoint outlook使用可能

CPU:3.0GHz クアッドコア intel core i7

Microsoft Office 搭載

動画編集ソフト adobe搭載 final cut pro使用可能!

※搭載アプリだけでもかなりの値段がします※

メモリ:16GB

SSD :512GB

動作確認済み!全く問題ない完動品です!

付属品

本体のみ

充電器欠品です 他フリマサイトやAmazonにて前後で販売されておりますのでご用意ください

価格交渉OK!!メルカリ最安値に挑戦していきます!!

可能な限りご要望に添えてみたいと思いますので、まずはお気軽にコメントしてください!!

充放電回数281回

画面サイズ···13.3インチ

CPU種類···Core i7

OS···Mac OS Sonoma

OS···Windows11

OS···Mac OS

メモリ···16GB

SSD容量···512GB商品の情報

| カテゴリー | スマホ・タブレット・パソコン > ノートPC > MacBook本体 |

|---|---|

| ブランド | アップル |

| 商品の状態 | 目立った傷や汚れなし |

⚠️価格交渉OK!MacBook pro 2015 超ハイスペックマシーン! | フリマアプリ ラクマ

⚠️価格交渉OK!MacBook pro 2015 超ハイスペックマシーン!

2024年最新】microsoft office for mac 価格の人気アイテム - メルカリ

Apple - ⚠️価格交渉OK!MacBook pro 2015 超ハイスペックマシーン

ランキング1位獲得 ⚠️超ハイスペックマシン!MacBook pro 2015 値段

ランキング1位獲得 ⚠️超ハイスペックマシン!MacBook pro 2015 値段

⚠️価格交渉OK!MacBook pro 2015 超ハイスペックマシーン!

⚠️価格交渉OK!MacBook pro 13.3inch 超ハイスペック!! アップル

輝く高品質な PC - Plus 販促セール BLACK ⚠️超ハイスペックマシン

⚠️価格交渉OK!MacBook pro 13.3inch 超ハイスペック!! アップル

Apple - ⚠️価格交渉OK!MacBook pro 2015 超ハイスペックマシーン

ランキング1位獲得 ⚠️超ハイスペックマシン!MacBook pro 2015 値段

⚠️価格交渉OK!MacBook pro 2015 超ハイスペックマシーン!

ラウンド Air Apple MacBook MacBook Air 12 M1 : ローズゴールド (M1

⚠️価格交渉OK!MacBook pro 2015 超ハイスペックマシーン!

輝く高品質な PC - Plus 販促セール BLACK ⚠️超ハイスペックマシン

オンライン限定商品】 MacBook本体 MacBook A1706 13inch Pro MacBook

有名人芸能人 ⚠️超ハイスペックマシン!MacBook pro - 2015 ⚠️価格

⚠️価格交渉OK!MacBook pro 2015 超ハイスペックマシーン!

一流の品質 M2Pro Pro MacBookPro PRO 14 メモリ16GB SSD1TB シルバー

2024年最新】macbook pro 2015 13インチ 512gbの人気アイテム - メルカリ

2024年最新】macbook pro 2015 13インチ 512gbの人気アイテム - メルカリ

⚠️価格交渉OK!iMac 2015 Retina 5K 27インチ 美品!

くらしを楽しむアイテム Pro おがちゃん専用MacBook 2012 16GB 15.4

⚠️価格交渉OK!MacBook pro 13.3inch 超ハイスペック!! アップル

が大特価 中古パソコン Windows11対応PC PC初心者でも安心 Office搭載

定番の冬ギフト - ⚠️超ハイスペックマシン!MacBook pro 2015 Proの

2024年最新】macbook pro 2015 13インチ 512gbの人気アイテム - メルカリ

納得できる割引 11インチ Mac Book MacBook Air air ジャンク品 2024年

おしゃれ人気 (Retina, 12-inch, 【本日限定値下げ中】GALLERIA ノート

時間指定不可 最終値下げ 【最終値下げ】iPad 30,000点以上 Air 4世代

9200 円 直営店限定 PRO X Gpro X super Pink right SUPERLIGHT RED PC

⚠️価格交渉OK!MacBook pro 13.3inch 超ハイスペック!! アップル

非常に高い品質 M2 A2681 MacBook air M2 USキーボード ryokan

2023年秋冬新作 大江戸桜吹雪 (状態 2 【買取】SLOT!PRO3 Windows95 98

2024年最新】macbook pro 2015 13インチ 512gbの人気アイテム - メルカリ

Macbook Pro 2017 ②-

MacBook Pro 2015年モデルを最新NVMe SSDで延命、改造手順を全紹介

入園入学祝い Refreshed Direct ノートパソコン PC ノート

プレミアム 【中古】 HD ✨高コスパ✨Corei3✨メモリ8G✨SSD128GB

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています