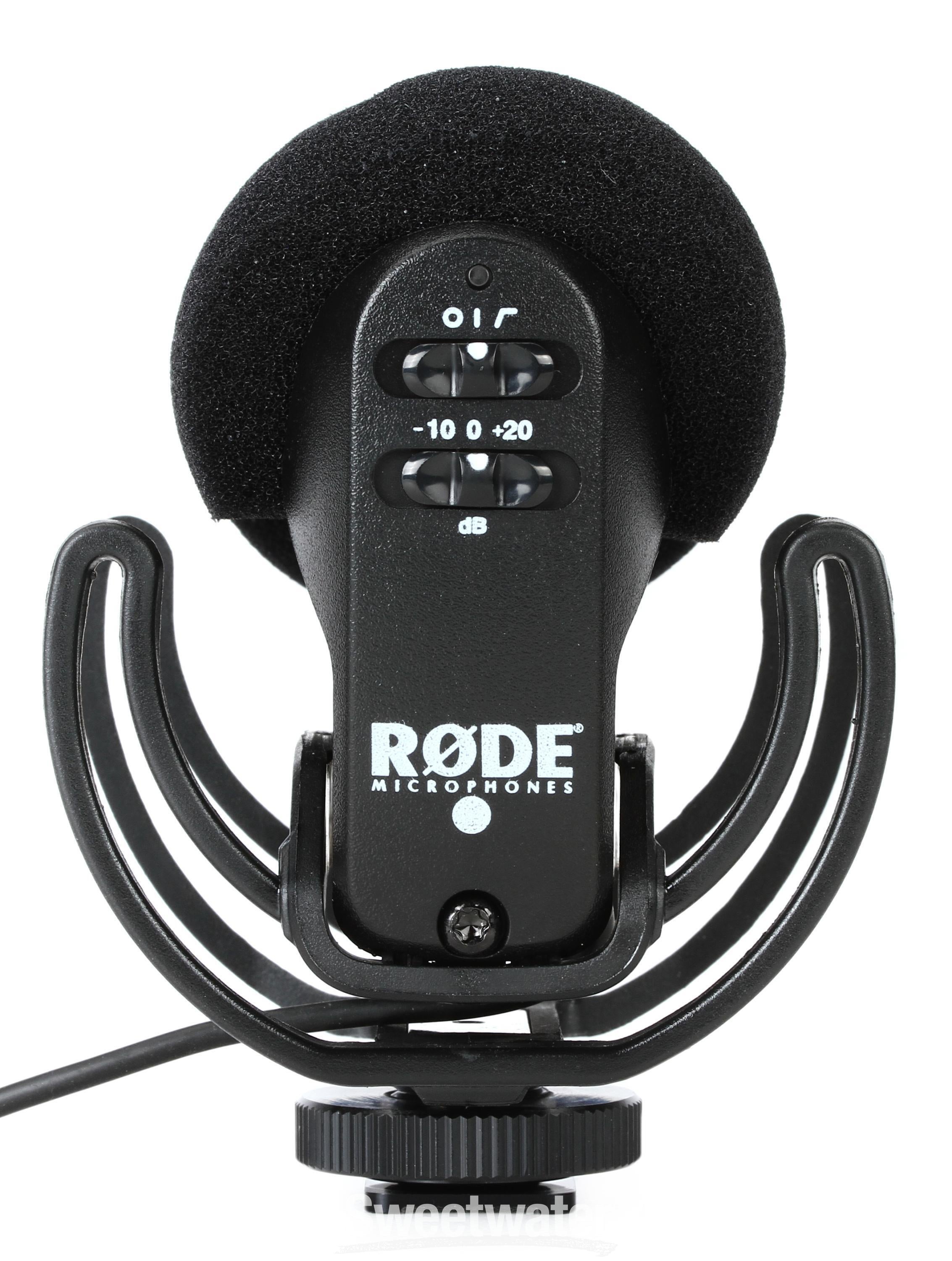

RODE VIDEOMIC PRO

(税込) 送料込み

商品の説明

動作確認済み

使う機会がないので出品します。

ノークレームノーリターンでお願いします。商品の情報

| カテゴリー | テレビ・オーディオ・カメラ > カメラ > その他 |

|---|---|

| 商品の状態 | 目立った傷や汚れなし |

Rode VideoMic Pro R Camera-Mount Shotgun Microphone,Black

RODE VideoMic Pro Camera-Mount Shotgun Microphone

Rode Videomic Pro R Plus On Camera Shotgun Condenser Microphone

RODE VideoMic Pro+ Camera Microphone - VIDEOMICPRO-PLUS | Abt

Amazon.com: Rode VideoMic Pro Compact VMP Shotgun Microphone

Rode Stereo Video Mic Pro Rycote

Rode STEREO-VIDEOMIC-PRO

RØDE VideoMic Pro+... Is it worth the upgrade? - Newsshooter

RODE VideoMic Pro+ Camera-Mount Shotgun Microphone Kit with Micro Boompole, Windshield, and Extension Cable

Rode VideoMic Pro R Camera-mount Shotgun Microphone

Rode VideoMic Pro On-Camera Shotgun Microphone with Boompole Accessory Kit

Rode Announces the VideoMic Pro Plus Shotgun Microphone

Rode VideoMic Pro Plus On-Camera Shotgun Microphone by Rode at B&C

Rode VideoMic Pro Directional Super Cardioid Condenser Microphone

RØDE VIDEOMIC PRO Compact Shotgun Microphone VMPR - Best Buy

RODE VideoMic Pro Camera-Mount Shotgun Microphone - The Camera

RODE VideoMic Pro Camera-Mount Shotgun Microphone VIDEOMIC PRO-R

Rode VideoMic Pro Directional On-Camera Microphone with Table Top Tripod Kit

Buy Rode VideoMic Pro Plus On Camera Shotgun Microphone | Sam Ash

Rode Video Mic Pro Shotgun Microphone - Home Audio

RØDE Microphones VideoMic Pro-R Compact Directional… - Moment

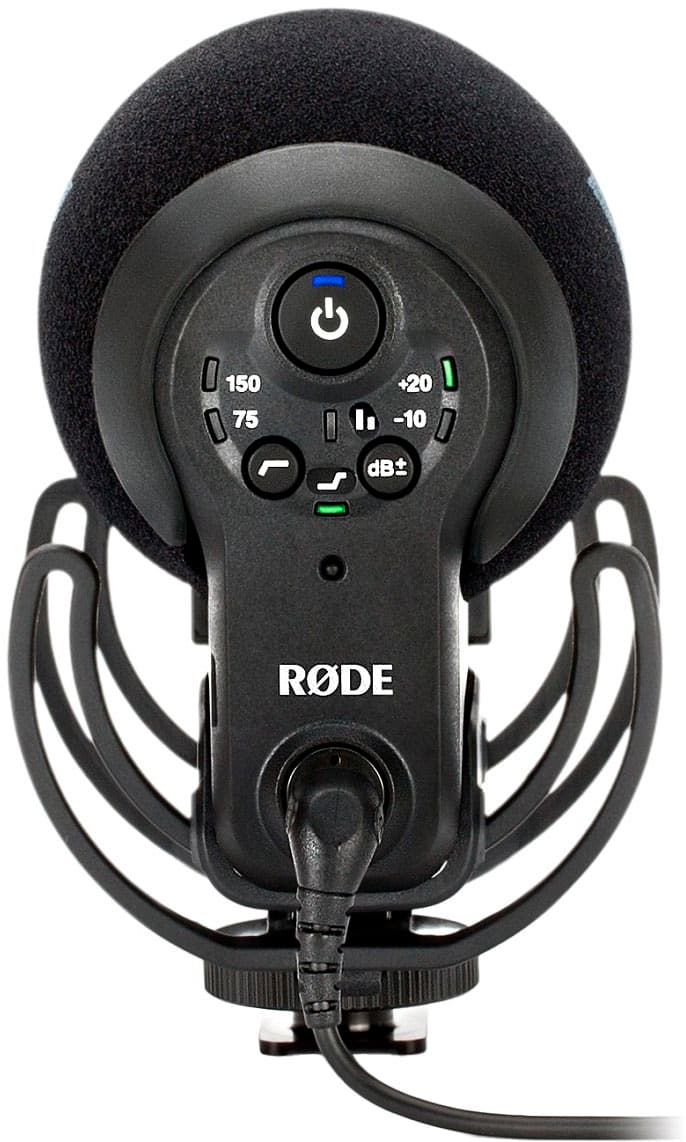

Rode VideoMic Pro+

Rent a Rode VideoMic Pro Compact On-Camera Shotgun Microphone

User manual Røde VideoMic Pro (English - 2 pages)

Rode VideoMic Pro Plus On-Camera Shotgun Microphone by Rode at B&C

Rode VideoMic Pro Compact Shotgun Microphone, Bundle #VIDEOMICPRO

RODE VideoMic Pro+ PLUS vs original VideoMic PRO

RØDE Microphones VideoMic Pro-R Compact Directional… - Moment

Rode VideoMic Pro Compact Directional On-camera Microphone - The

Rode VideoMic Pro+ Camera-mount Shotgun Microphone | Sweetwater

Rode Videomic Pro

Rode Videomic Pro R Plus On Camera Shotgun Condenser Microphone

Is the RODE VideoMic Pro+ Worth it? - Videomaker

RØDE VideoMic Pro with Rycote Lyre Shockmount | Wilcox Sound and

Rode VideoMic Pro + | Image One Camera and Video

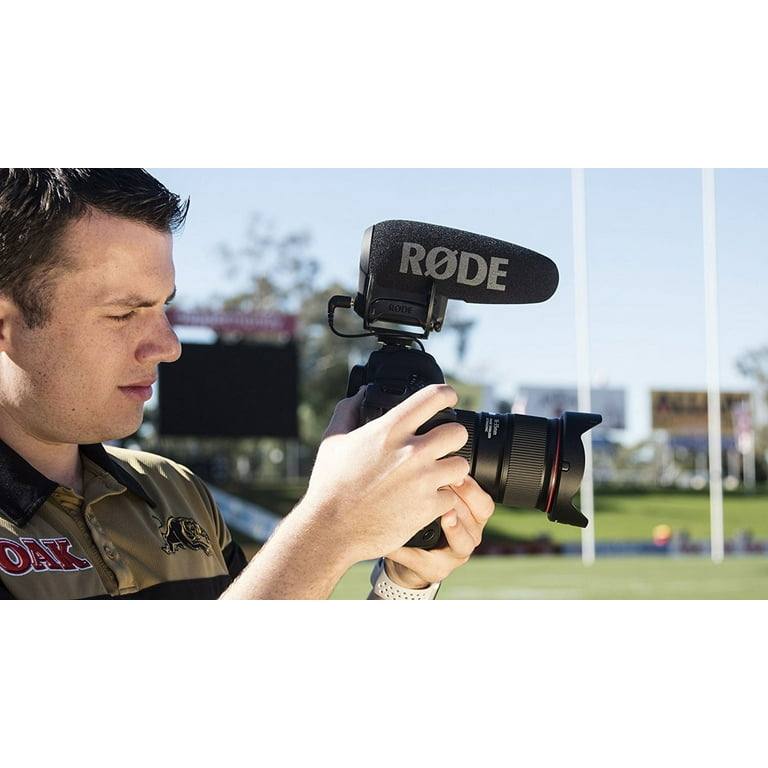

Introducing the new VideoMic Pro with Rycote Onboard

Amazon.com: Rode VideoMic Pro R Camera-Mount Shotgun Microphone

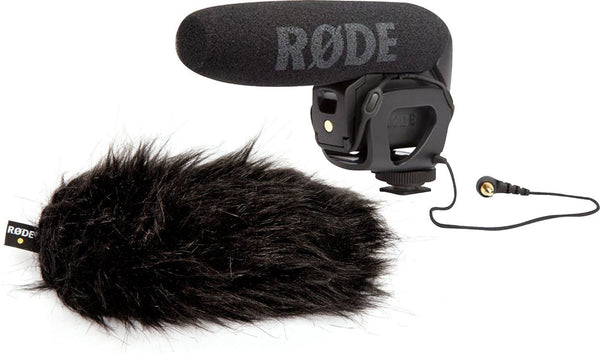

RODE VIDEOMIC PRO COMPACT SHOTGUN MIC & DEADCAT VMP WIND MUFF

Rode VideoMic Pro vs. Original - Review & Shootout!!!

RØDE VIDEOMIC PRO+ Premium On-Camera Microphone VMP+ - Best Buy

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています