TALEX トゥルービュー オーバーグラス⟡.·*.

(税込) 送料込み

商品の説明

TALEX

トゥルービュー オーバーグラス

レッド

自然な見え方で眩しさを軽減します。

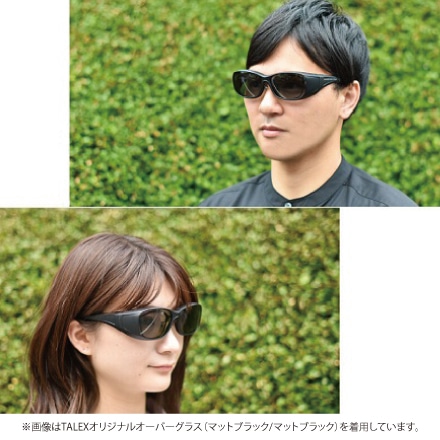

レディースでもメンズでもお使いいただけます。

試着のみの未使用品です。

画像のものが全て付属品です。

#さくらの商品37415.商品の情報

| カテゴリー | ファッション > レディース > 小物 |

|---|---|

| ブランド | タレックス |

| 商品の状態 | 新品、未使用 |

オーバーグラス -TRUEVIEW® – TALEX online store

オーバーグラス -TRUEVIEW® – TALEX online store

![EMCオーバーグラス[ホワイト] -TRUEVIEW FOCUS](http://store.talex.co.jp/cdn/shop/products/emc_pw_bro_tvf.jpg)

EMCオーバーグラス[ホワイト] -TRUEVIEW FOCUS

![EMCオーバーグラス[ダークグレー] -TRUEVIEW®](https://store.talex.co.jp/cdn/shop/products/emc_gdg_nv_tvf_1400x.jpg)

EMCオーバーグラス[ダークグレー] -TRUEVIEW®

オーバーグラス -TRUEVIEW®

激安通販サイト) TALEX トゥルービュー オーバーグラス⟡.·*. - 小物

オーバーグラス -TRUEVIEW SPORTS – TALEX online store

紫外線、花粉の侵入もガードするオーバーグラス】TALEX(タレックス

激安通販サイト) TALEX トゥルービュー オーバーグラス⟡.·*. - 小物

![EMCオーバーグラス[ブラウン] -TRUEVIEW SPORTS](http://store.talex.co.jp/cdn/shop/products/emc_dbr_or_tvs.jpg)

EMCオーバーグラス[ブラウン] -TRUEVIEW SPORTS

激安通販サイト) TALEX トゥルービュー オーバーグラス⟡.·*. - 小物

2022年レディースファッション福袋特集 TALEX トゥルービュー オーバー

2024年最新】オーバーグラス タレックスの人気アイテム - メルカリ

TALEXオリジナルオーバーグラス レッド トゥルービュー EM6-D0301

TALEX トゥルービュー オーバーグラス⟡.·*. タレックス 50%OFF半額

激安通販サイト) TALEX トゥルービュー オーバーグラス⟡.·*. - 小物

2022年レディースファッション福袋特集 TALEX トゥルービュー オーバー

オーバーグラス -TRUEVIEW SPORTS – TALEX online store

TALEX トゥルービュー オーバーグラス⟡.·*. タレックス 小物 激安

2024年最新】talexオーバーグラスの人気アイテム - メルカリ

オーバーグラス -TRUEVIEW® – TALEX online store

TALEX トゥルービュー オーバーグラス⟡.·*. タレックス 50%OFF半額

2024年最新】オーバーグラス タレックスの人気アイテム - メルカリ

TALEX EMCオーバーグラス グロスダークブラウン/ブロンズ トゥルービュースポーツ EM6-D03C12

紫外線、花粉の侵入もガードするオーバーグラス】TALEX(タレックス

オーバーグラス -TRUEVIEW SPORTS – TALEX online store

みおのとおちゃん物欲日記:TALEXオーバーグラス

2024年最新】オーバーグラス タレックスの人気アイテム - メルカリ

紫外線、日差しの侵入もガードするオーバーグラス】TALEX(タレックス

紫外線、花粉の侵入もガードするオーバーグラス】TALEX(タレックス

激安通販サイト) TALEX トゥルービュー オーバーグラス⟡.·*. - 小物

TALEX偏光レンズ 超軽量オーバーグラス EM6-D03(タレックス

2024年最新】タレックス トゥルービューの人気アイテム - メルカリ

TALEX EMCオーバーグラス グロスダークブラウン/ブロンズ トゥルービュースポーツ EM6-D03C12

紫外線、花粉の侵入もガードするオーバーグラス】TALEX(タレックス

TALEXオリジナルオーバーグラス レッド トゥルービュー EM6-D0301

2024年最新】タレックス トゥルービューの人気アイテム - メルカリ

激安通販サイト) TALEX トゥルービュー オーバーグラス⟡.·*. - 小物

TALEX偏光レンズ 超軽量オーバーグラス EM6-D03(タレックス

2024年最新】talexオーバーグラスの人気アイテム - メルカリ

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています